Changing debt collection.

For good.

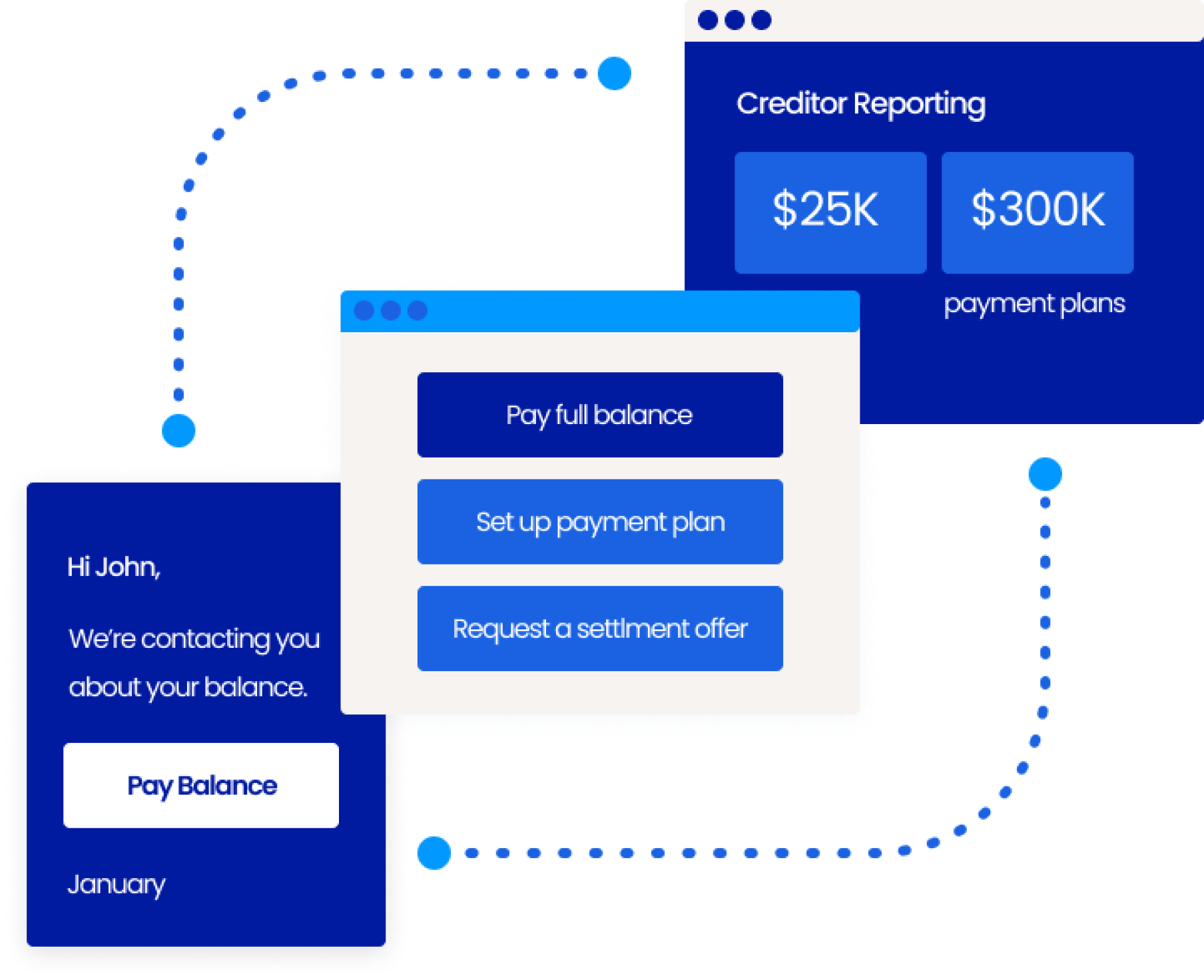

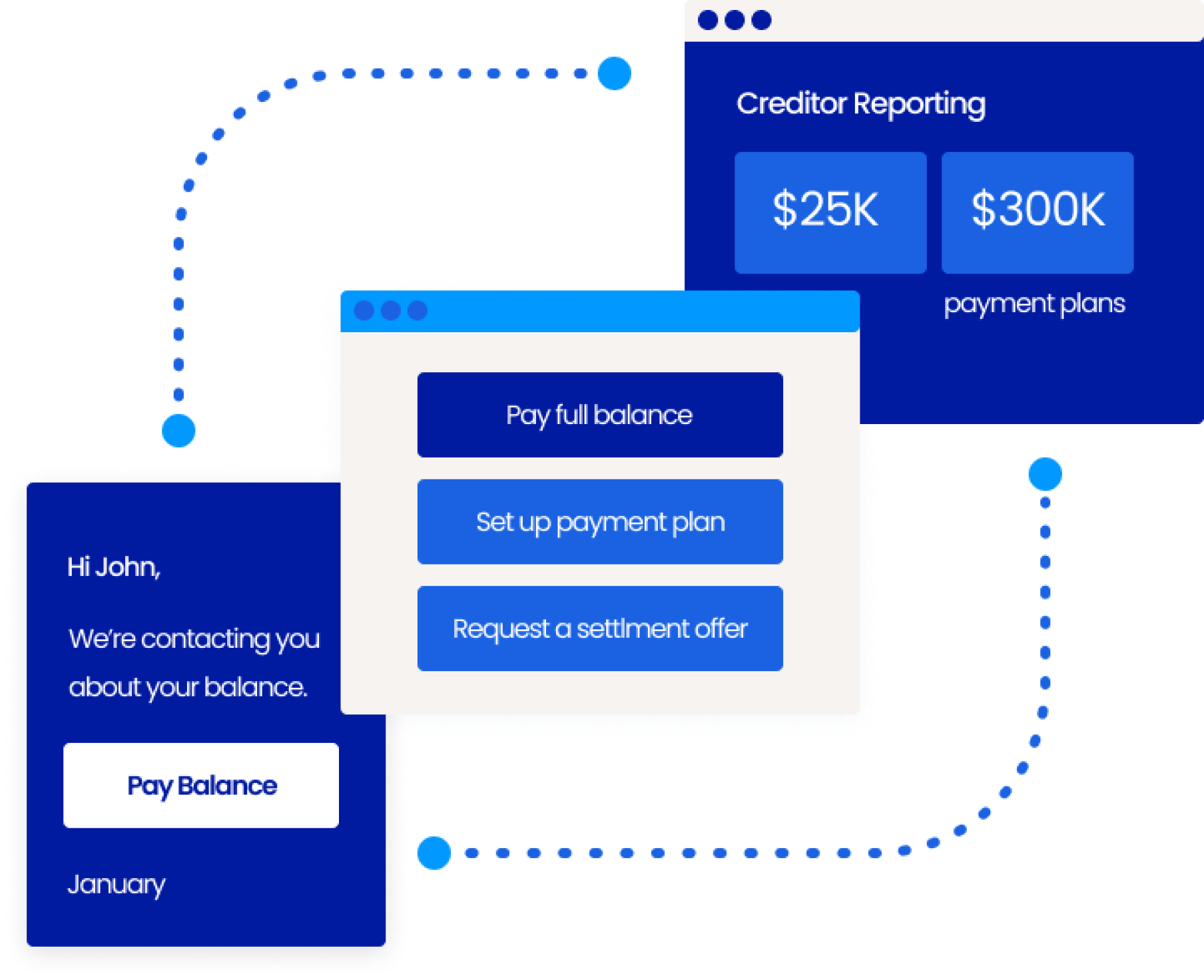

January sets a new standard for humanized debt collection. Our tech-enabled platform improves recovery rates and sets creditors and borrowers up for success.

January sets a new standard for humanized debt collection. Our tech-enabled platform improves recovery rates and sets creditors and borrowers up for success.

Accreditations and Memberships

Improved Recovery Rates

Creditors using January recover more than the national average.

Reduced Risk

Automated compliance safeguards protect against reputational and legal risk.

Regain Financial Stability

Borrowers can resolve outstanding debts on their own terms.

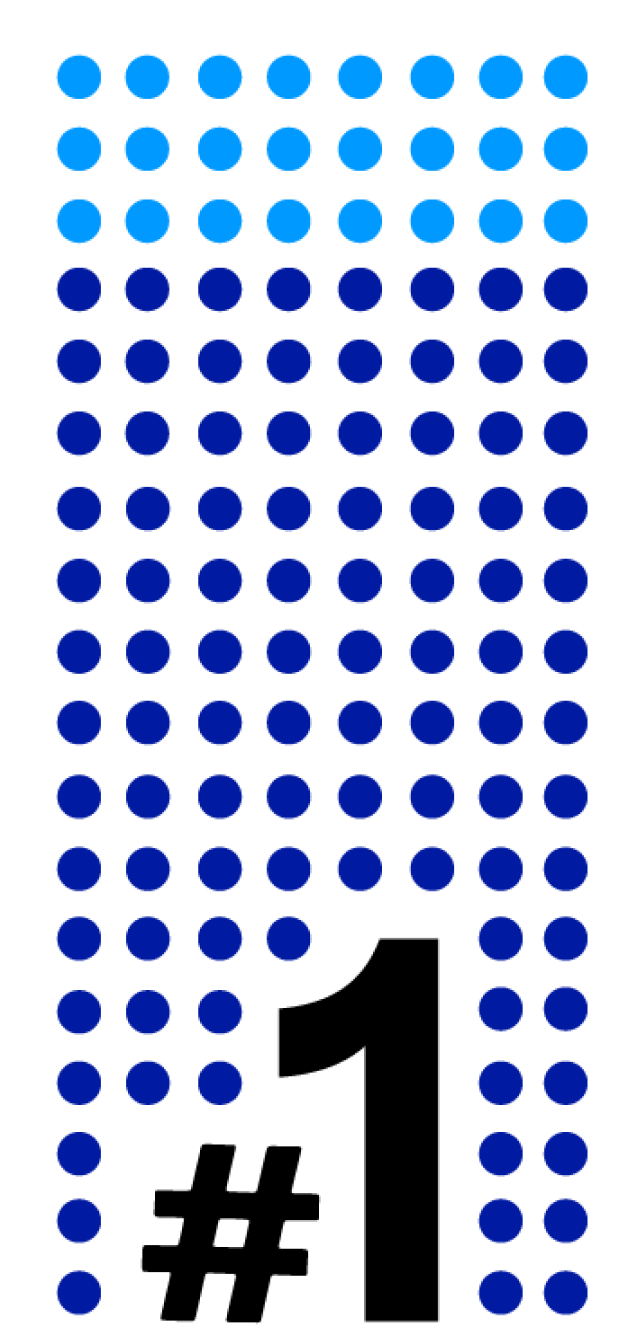

More efficient than traditional collection agencies.

Source of debt recovery for 90% of our clients.

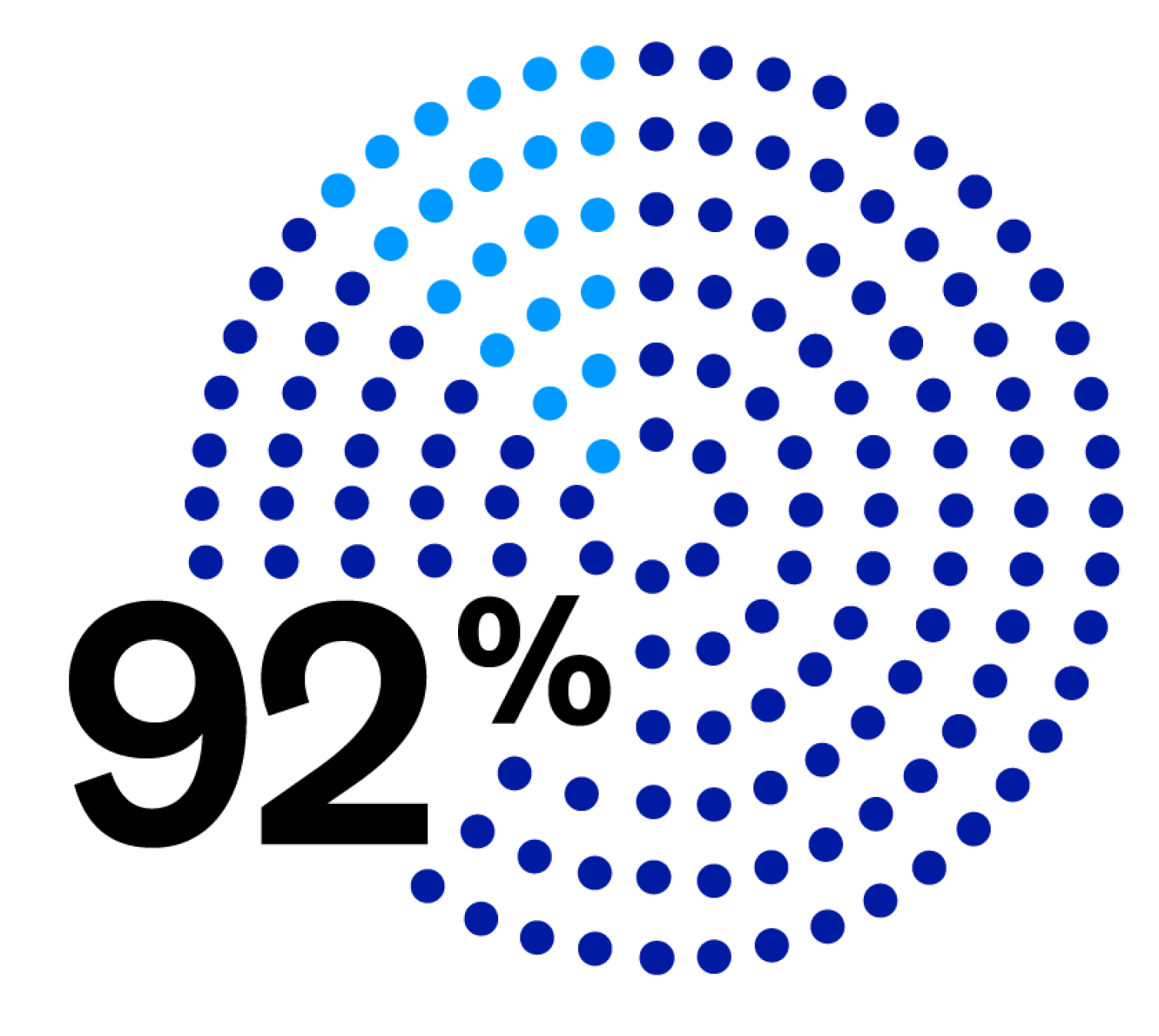

Of accounts are closed exclusively on our digital platform.

Real-time monitoring builds trust for creditors. An empathetic approach increases repayment rates for borrowers.

Real-time monitoring builds trust for creditors. An empathetic approach increases repayment rates for borrowers.

Real-Time Auditing

Review every interaction on every account with a click.

Intelligent, Automated Compliance

Our platform reduces risk by automatically complying with all regulations.

Individual Approach

Treating borrowers like more than a number improves collections and protects creditors' reputations.

Our intelligent compliance system automatically adheres to all federal, state, and local regulations. Wherever borrowers are, we interact with them according to the letter of the law.

Book a demo to learn how January improves your collection rates while protecting your reputation.